-40%

C 00 Stimulas Check by IRS. A full Refund of your taxes by a simple method

$ 10.53

- Description

- Size Guide

Description

Price Reduced!Went from 0 down to to prove a point.

If you cannot receive over 00 in tax savings by reading this book and putting it into use,

then I will double your investment and refund you twice what you paid for it.

Start with a ,000 Refund Check from the United States Government and each year, instead of paying or letting the government keep what has been withheld from you paycheck, get a Refund that can be over ,000 year in and year out. The big boys are doing it, why can't you? Start a small business, watch it grow and have the IRS fund your start up with a huge refund.

Start with a few basic premises;

A. the IRS will not let you write off mileage to and from work. It is called commuting. Your accountant will not let you do it. Neither will the IRS

B. The average guy in America drives over 12,000 miles per year. A little less than half of that is commuting back and forth to work or driving to your local supermarket to get groceries. Again, Commuting, Can't write it off. The IRS allows 58 cents per mile for business use of a vehicle. That's over a 00 tax write off for the average guy. That's about a Two Thousand Dollar refund for a guy in the top bracket. Add State Refund to it and you are approaching ,000. That's just mileage. We haven't even began to write off business assets yet. That is a whole new item.

C. The Tax Reform Act of 2017 took away even your exemptions. No longer a Write Off. It also took away most of employee business expenses as it is hard to exceed standard deductions on a normal tax return. By starting a business, you can now take all of these work related expenses to a Schedule C providing it is in the production of income. We will show you how.

D. If you could deduct mileage or gas, oil, repairs, insurance, bank loans, depreciation on your car or totally write it all off, the entire purchase price of a new car in one year even if not paid for, it would pretty much take out your tax liability and give you back just about everything you paid in or what was withheld from your paycheck. Priced a new Ford or Chevy Dually 1 Ton Pick up Truck lately? They are knocking on the door of ,000 loaded. Buy a truck with GVW over 6,000 lbs. and you can write the whole thing off in one year even if it is not paid for and you decide on installment payments over seven years. Pretty cool! Got any idea of what a ,000 write off in one year might do to your Adjusted Gross Income?

E. You need to follow some basic steps and then go do it. It's a mine filed out there when you deal with the IRS but I will show you how step by step to get all of your money back each and every year from the IRS in form of a tax refund. About One out of Ten makes some pretty serious money out there in business for themselves. Be one of the Ten. Follow our guidelines and start a small business. You don't have to follow our business model, you can go pick one out you like. Even some of the greatest hobbies have turned into monster businesses. Do what you like to do. Don't wake up thinking you are going to work.

F. It is all legal. It is right out of the IRS code. We don't use some made up figures that some Tax Shelter guy tried to sell you on. We use the actual IRS publications, guidelines, the Code and many of the same IRS forms that are used to file your tax return.

G. To good to be True? According to the Department of Treasury, IRS,

There were about 112 million

refunds

issued totaling 0 billion, with the average

refund

being ,869, a 1.4 percent drop from ,910 the

previous year

.

This was dated Feb 5, 2020 so it is current information.

H. Most of these refunds were using my method. It is not a secret, they were filing small business tax returns with depreciation, writing off their cars and trucks and yes, some of them were even writing off in home office expense. I know a guy who wrote off a trip to Disneyland. They actually paid him to go and document it. I had a Doctor go on a Cruise Ship and attend a Seminar while he was on it for a couple of hours. The whole thing was a write off. The guy in the next cabin was an Uber driver. He was writing his trip off also. Both in the same Seminar.

I. You don't have to buy my full research project to figure it all out. You can go to Arizona State University for four years like I did, you can get your MBA like I did. You can spend 40 years doing tax returns, like I did. You can personally be responsible for over One Thousand Two Hundred Tax returns per year, mostly business returns, like I did. OR, you can pay me for what I know and a road map to getting it all back.

J. The IRS is NOT going to like this. They would prefer you simply give them a chunk of money each year. You can beat them at their own game and use their rules, their guidelines, their court cases, their forms, their instructions and do every single thing by the book. 100%. If what I tell you is not in the IRS code, I will give you back your money, in full. That's a lifetime guarantee.

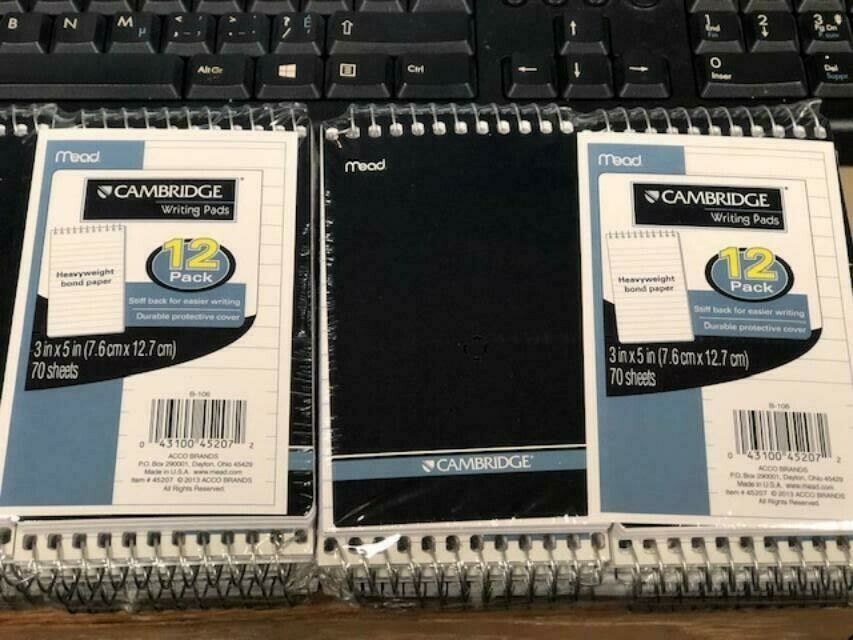

K. The book is just to big to send by email attachment. I have put it all on a thumb drive and will mail it too you. It is just too big to print out; too many pages. I stopped counting at page 200 as the actual IRS code of over 51,000 pages and we deal with approximately 1% of that code. It's full of color photos, IRS tips and publications and if you don't like it, send it back. Full no question refund but you won't want to part with it. You can take that to the Bank. We even suggest a small startup business that you can enter into for under fifty dollars but has the potential of earning you hundreds of thousand of dollars if you are simply willing to work it.

And if you are really lazy, we will show you how to drive around town in a Corvette and get paid for it.

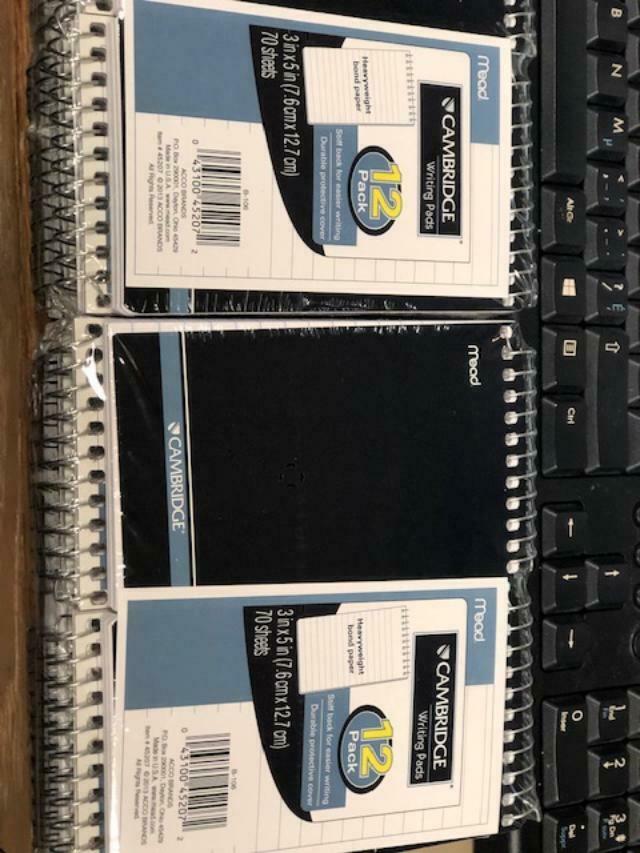

Now let's look at the above photos and let me walk you through it;

Photo #1 is a stack of cash. That needs no explanation and that is what you will get from the IRS if you listen to the guidelines and follow what I suggest you do. It's pretty simple. It's cash.

Photo #2 is an old used car from the sixties. Pretty cool car I will admit and I will show you how to write it off. If the car was over 6,000 Gross Vehicle weight, you could write it all off in one year even if it wasn't paid for. Pretty cool, but we will show you how to start with an old used car and move up to a new one. You can still get 58 cents a mile deduction even if you can't write it all off in one year. ,000 write off still isn't such a bad consolation prize.

Photo#3 You have probably been trying out various get rich quick schemes and they don't work. Maybe it is time to switch to plan C and try and proven method, an IRS refund, to get you started to wealth.

Photo#4 We will provide backup with a team of professional Accountants, Tax Attorneys and paralegals versed in tax law. We won't lose one single case, it will effect our business and we will not let that happen. Mary Kay Cosmetics use to buy her best salesmen Pink Cadillac's (You have probably seen them driving around). When the IRS tried to disallowed it, old Mary Kay showed up in Tax Court with 28 Harvard Trained Attorneys that made hamburger meat out of the District Counsel. We will send you an itemized list of what you need to do to win your case if ever audited. Here is an example of what the IRS would like for you to do:

Hobby-loss rules

If you make a profit for three out of the last five years, the IRS assumes you’re engaged in an activity to make a profit. If so, you can deduct losses from the activity. However, if an activity isn’t for profit, you can only deduct expenses up to the amount of your hobby income. Expenses more than the income are nondeductible losses. To learn more, see the Hobby Income tax tip.

The IRS considers these factors when deciding if your activity is a business or a hobby:

Manner that you conduct the activity

Expertise of you and your adviser

Time and effort you used to conduct the activity

Expectation that assets used in the activity might appreciate in value

Your success in conducting other similar or dissimilar activities

Your history of income or losses in regard to the activity

Amount of occasional profits you earned

Your financial status

If the activity has elements of personal pleasure or recreation

To learn more about business income and losses, see Publication 334: Tax Guide for Small Business.

The problem with the above statement is absolutely false. Just ask Jeff Bezos. He started a little book selling operation in his garage. Went ten years without showing a profit. Lost his butt each every year for 9 1/2 years before finally, the light at the end of the tunnel. His company is now known as Amazon and he is the richest man in the world with over 130 Billion Dollars in net wealth according to Forbes magazine. The tax court laughed at the IRS when they tried to pull that hobby loss stuff.

Photo#5 Our plan is so simple, it's like hiding in the bushes and taking a photo. If you follow what we suggest, you will put thousands upon thousands of dollars in your pocket just from tax savings. Follow us a little closer and you will put thousands upon thousands of earned income dollars as well. Like everything, it take a little work to get ahead in the is world. Without it, you sit on the sidelines and watch the band go by.

Photo#6 You will need a computer, a cup of coffee and a little imagination to take you where we are going to take you. In my tax practice, I once asked most of the millionaires what the key to success was. Not all were the same but they all said that once they discovered what it was to succeed, it was easier than they ever imagined to achieve success.

Photo #7 Don't be the guy running in a hundred different directions. Set your goal, stick to it and go get it done. So many people are chasing Rainbows and get rich quick schemes they simply forget to look at the basics. The harder I work, the luckier I get. Pretty simple. Set out a roadmap and follow directions.

Photo #8 represents Trust. We are simply an email away. We are here to help you and we know what we are talking about. Trust takes time to build and as your progress forward, one step at a time, you will find out that we know what we are talking about.

Photo#9 We all reach crossroads in our life. To go this way or that way becomes the decision. Robert Frost once summed it up in a poem and he "took the road less traveled" and it made all the difference in his life. You are at a crossroads in your life right now. You can take the road that everyone else does or you can travel to the beat of a different drummer.

Photo#10 That is a photo of a Winner at a finish line. Our endeavors may not be that dramatic or have that much impact on our lives. Then again, it could be greater. We are only put on this earth for a short period of time and we have a pretty short fuse at about 70 or 80 years. Some get a little longer some not so much. It is what we do with those years that determines if at the end of our life, it is said about us; "the world was a better place because he or she once walked upon it". Be remembered for something.

Photo#11 is make things happen. You can sit on the sidelines and watch the band march by. You can get up and go out and lead the band and be part of something. You determine if you are going to make it happen or just sit on the sidelines. Do something. Be Something.

Photo#12. Drive off into the Sunset in a new Corvette. We started out with an old used one and we are finishing up with a bright shinning new fresh one. It still doesn't qualify for a 100% write off in the first year, but what the heck, it is just to gorgeous not to include in our listing.

We are offering a full guide on a thumbdrive. In it is a book on how to write your car off if you are driving too and from work. It also tells you how to start a really lucrative business. You can make more than you write off. That by the way is what is meant by the American Dream and how to be successful and not fail in business. Make money.